san francisco sales tax rate breakdown

Minus Tax Amount 000. Has impacted many state nexus laws and sales tax collection requirements.

California Taxpayers Association California Tax Facts

Your Income Taxes Breakdown.

. File Monthly Transient Occupancy Tax Return. The San Francisco County California sales tax is 850 consisting of 600 California state. Plus Tax Amount 000.

All in all youll pay a sales tax of at least 725 in California. Most of these tax changes were approved by. The transient occupancy tax is also known as the hotel tax.

This includes the sales tax rates on the state county city and special levels. Its base sales tax rate of 725 is higher than that of any other state and its top marginal income tax rate of 133 is the highest state income tax rate in the country. Fast Easy Tax Solutions.

California Sales Tax. Sales tax region name. The total sales tax rate in any given location can be broken down into state county city.

The true state sales tax in California is 6. Our GIS-based sales tax website allows the user to view sales tax receipts from calendar. Stockton California with a 875 sales tax but the goods will be used stored or consumed in San Francisco which has a sales tax rate of 950 then the department needs to accrue the additional 075 sales tax in the Agency Fund and not pay it to the vendor.

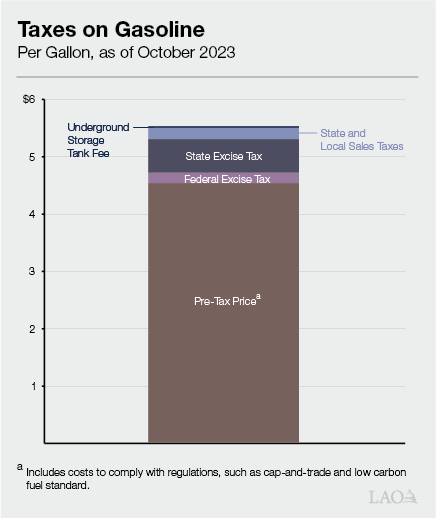

For sellers closing costs usually run in the range of 6 to 7 of the sales price not including loan pay-off and any significant home preparation staging or. The minimum sales tax in California is 725. 4 rows 8625 tax breakdown.

The San Francisco County sales tax rate is. In San Francisco the tax rate will rise from 85 to 8625. The California sales tax rate is currently 6.

To review the rules in California visit our state-by-state guide. California has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 35. The average cumulative sales tax rate in South San Francisco California is 988.

San Francisco Tourism Improvement District. This is the total of state county and city sales tax rates. Ad Find Out Sales Tax Rates For Free.

This scorecard presents timely information on economy-wide employment indicators real estate and tourism. South San Francisco is located within San Mateo County California. Within South San Francisco there are around 2 zip codes with the most populous zip code being 94080.

For Use Tax FAQ sales and use tax rates refer to. Automating sales tax compliance can help your business keep. 3 rows Sales Tax Breakdown.

The statewide tax rate is 725. The state then requires an additional sales tax of 125 to pay for county and city funds. The County sales tax rate is 025.

4 rows Sales Tax Breakdown. This tax does not all go to the state though. Those district tax rates range from 010 to 100.

In most areas of California local jurisdictions have added district taxes that increase the tax owed by a seller. Presidio San Francisco 8625. The minimum combined sales tax rate for San Francisco California is 85.

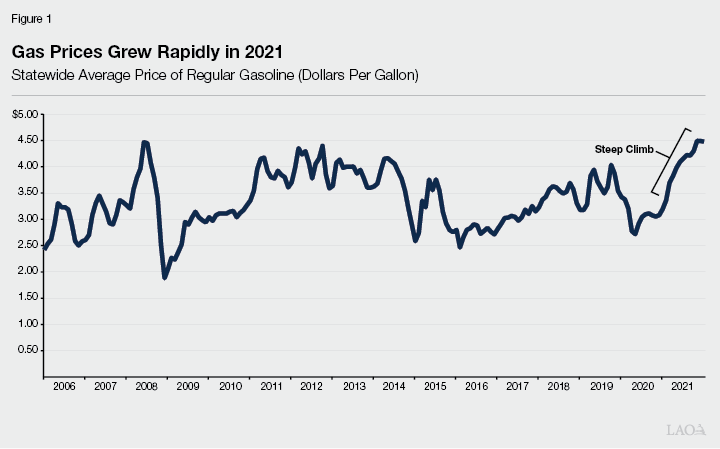

The Sales and Use tax is rising across California including in San Francisco County. Presidio of Monterey Monterey 9250. Enter an amount into the.

Other than loan-related fees the big costs for buyers are for escrow fees and title insurance home inspections the first year of hazard insurance and property tax pro-rations if any. The San Francisco sales tax rate is 0. The purpose of the Economy scorecard is to provide the public elected officials and City staff with a current snapshot of San Franciscos economy.

The 2018 United States Supreme Court decision in South Dakota v. The California state sales tax rate is currently. The 85 sales tax rate in san francisco consists of 6 california state sales tax 025 san francisco county sales tax and 225 special tax.

San Francisco imposes a 14 transient occupancy tax on the rental of accommodations for stays of less than 30 days. The tax is collected by hotel operators and short-term rental hostssites and remitted to the City.

94110 Sales Tax Rate Ca Sales Taxes By Zip

Filing Taxes On H1b Visa The Ultimate Guide

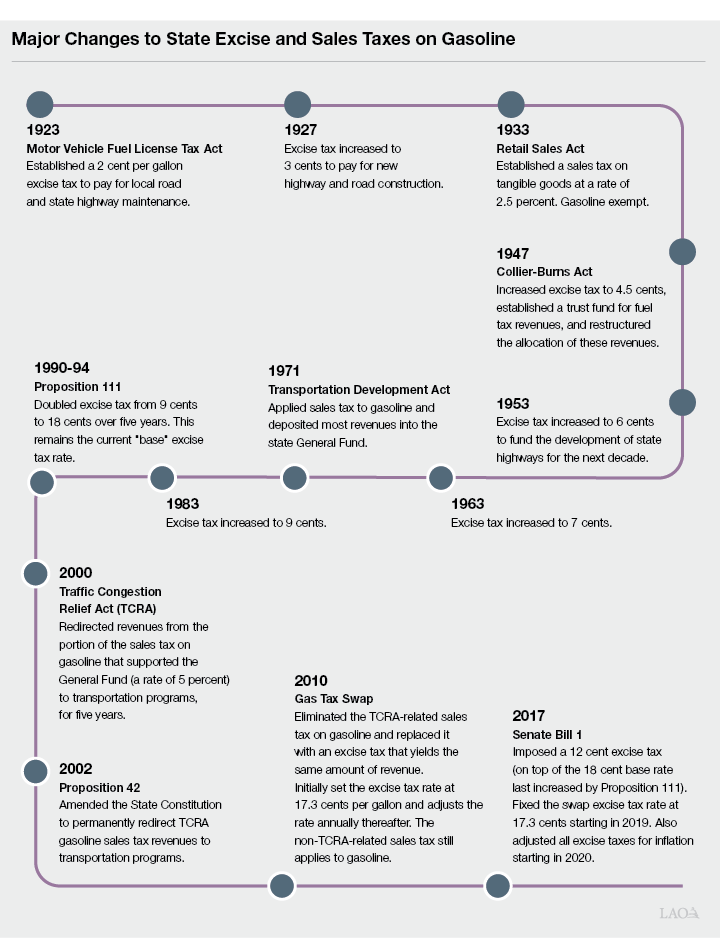

The 2022 23 Budget Fuel Tax Rates

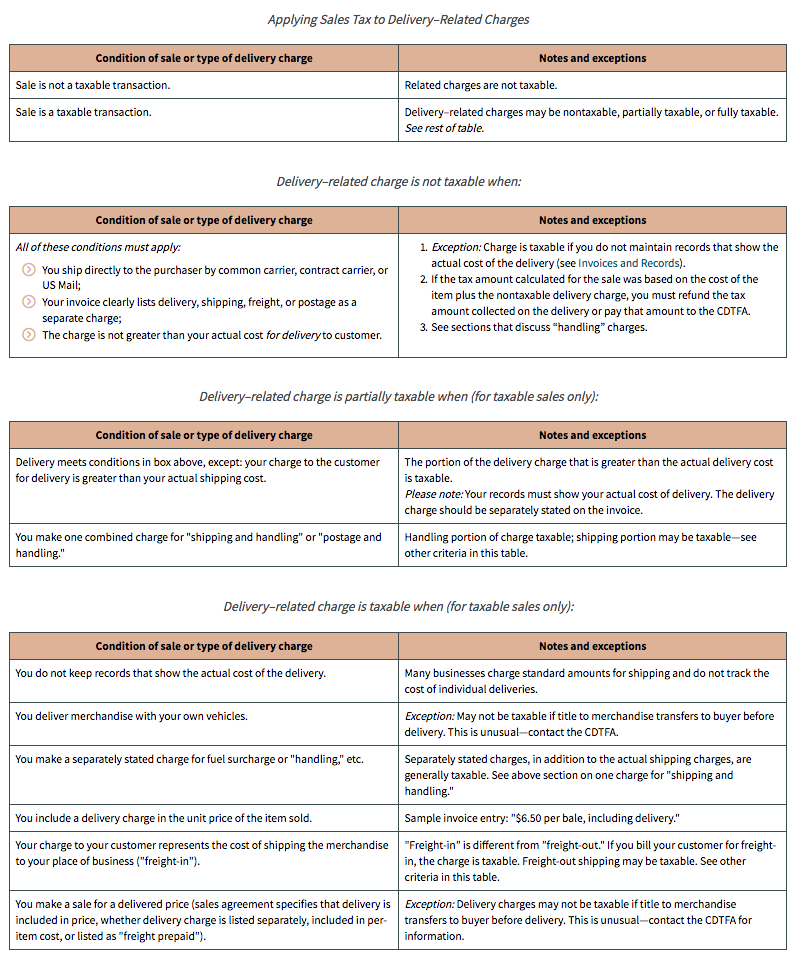

Is Shipping In California Taxable Taxjar

Is Tax Higher In New York Than In California Quora

California State Taxes 2021 2022 Income And Sales Tax Rates Bankrate

Origin Based And Destination Based Sales Tax Rate Taxjar

How Much Is California Dispensary Sales Tax Breakdown

How Does California Sales Tax Work Brotman Law

California State Taxes 2021 2022 Income And Sales Tax Rates Bankrate

California Taxpayers Association California Tax Facts

Overland Park Kansas Sales Tax Rate Is 9 1

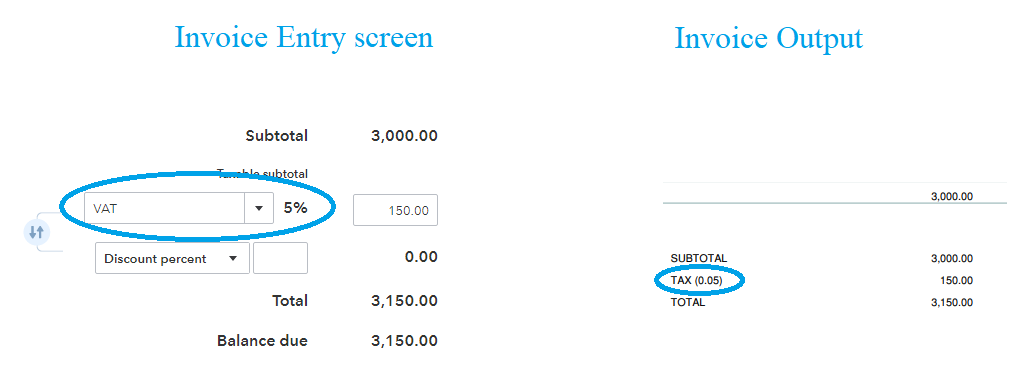

Solved Sales Tax Setup In Quickbooks Online

California State Taxes 2021 2022 Income And Sales Tax Rates Bankrate

California State Taxes 2021 2022 Income And Sales Tax Rates Bankrate

New York City Waives Hotel Room Occupancy Tax For The Summer New York Business Journal